Third Quarter, 2023

Click here for a printable version of the Investment Update.

Preparing for a New Investment Era

Despite a third-quarter decline, equity markets remain positive year to date. We think a new era for investors is emerging that will likely be less favorable for the investment strategies that have delivered strong returns in the past. We are carefully repositioning Thematic Equity portfolios for the changes we expect.

The Third Quarter in Brief

Global and U.S. equity returns were negative in the third quarter but remain strong year to date. As of September 30, the S&P 500 returned 13.1%, and the MSCI All-Country World Index (ACWI) 10.5% despite higher interest rates and elevated inflation.

Fixed income indices were also down in the quarter, and returns are negative year to date. Unless interest rates decline materially in the fourth quarter, 2023 will mark the third consecutive year of negative fixed income returns, as measured by the Bloomberg U.S. Aggregate Index. Since its inception in 1976, the Index has never been down even two years in a row until 2021-22.

Sustained inflation and the Federal Reserve’s efforts to tame it drove fixed income’s negative return. Over the past 18 months, the Fed has raised short-term interest rates 11 times, lifting the Fed Funds Rate from 0%-0.25% to 5.25%-5.50%. The speed and magnitude of these rate increases led many economists and market strategists to predict that a U.S. recession was right around the corner.

So far though, the U.S. economy has defied expectations. Its persistent strength, coupled with declining inflation and a slowdown in both the pace and size of interest rate increases, led many to shift their expectations from imminent recession to soft landing.

The unexpected resilience of the U.S. economy stemmed largely from continued strong consumer activity. After unprecedented pandemic-related fiscal stimulus, U.S. consumers in aggregate had significant excess savings, which they used in part to pay down debt. Meanwhile, a tight labor market pushed up wages, even in inflation-adjusted terms, and years of extremely low interest rates allowed consumers and corporations to lock in low fixed rates on long-term debt.

Consumers’ healthy balance sheets and low rates on long-term debt have thwarted the impact of the Fed’s recent rate increases so far. In the past, when the Fed wanted to rein in inflation, it could count on higher interest rates to reduce spending. Consumers would forgo purchases so they could make higher required monthly payments on their variable-rate loans, particularly mortgages. Corporations would reduce capital spending as debt grew more expensive. Not this time. Given the composition of current mortgage debt, the effective interest rate on all outstanding mortgages has increased by only a quarter of a percentage point from the all-time low of 3.3% set in early 2022, despite rates on new mortgages soaring above 7%. For many homeowners, whose income has kept pace with increases in consumer prices, making mortgage payments is easier than it was a few years ago, freeing them to spend more.

However, we’re not out of the woods yet. The lag between rising interest rates and an economic contraction can be long. Eventually, consumers and companies will exhaust their excess savings and need to take out new loans. In our view, there is a high probability that higher interest rates will tip the U.S. economy into recession sometime in 2024.

The Longer View

In our second-quarter Investment Update we focused closely on our Themes. In this Update we focus on our long-term outlook. It has changed meaningfully in recent years, with significant implications for investment strategy.

The Golden Years

The past four decades have been great for U.S. financial markets. From 1982 to early 2022 almost every asset class – most notably equities – soared in value. The S&P 500 Index rose from a low of 102 in August 1982 to its peak of 4,796 at the beginning of 2022, for a compound annual return of 10.3%.

This amazing 40-year run of performance had many drivers, including:

▪ Declines in effective tax rates, due to lower statutory rates and increased use of tax shelters

▪ Improvements in technology and management techniques that boosted productivity

▪ Increased globalization that reduced labor and production costs and increased international sales

But in our view, the biggest single contributor to the phenomenal performance of all financial assets over the past 40 years, and especially the last 15, was the relentless decline in interest rates, which contributed both to stronger earnings growth and to higher multiples.

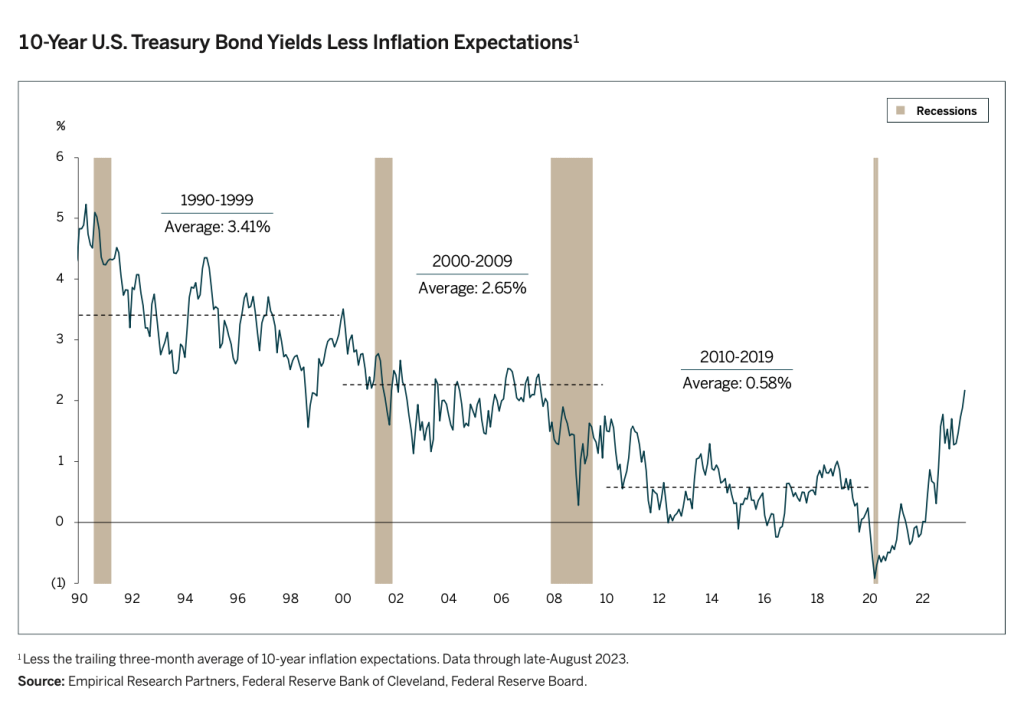

Yields on the 10-year U.S. Treasury fell from nearly 15% at their peak in 1980 to 0.66% at their low in June 2020, as inflation declined from a post-war high to an unprecedented low. The 15-year period after the Global Financial Crisis was the icing on the cake. The real (inflation-adjusted) Fed Funds rate was negative for most of this period, and real long-term bond yields averaged less than 1% from 2010 to 2020.

Unprecedented low interest rates pushed corporations and investors to take on more risk to generate return. Corporations borrowed on very attractive terms to finance capital investments and stock repurchases. Investors shifted from bonds into equities, real estate, private equity and eventually into highly speculative instruments like digital currencies and NFTs.

A New Era Dawns

Today, by contrast, investors can get solid returns from Treasury bonds and other fixed income securities, and many of the other tailwinds for equities have dissipated. On the earnings front, further tax cuts are unlikely, given the Federal government’s high debt level. Labor costs are on the rise, driven by shifting demographics and a slowed pace in offshoring. Spurred by pandemic-era issues and geopolitical concerns, multinational corporations are redesigning supply chains for resilience and relocating production closer to home, often at additional cost.

Multiples are also under pressure, as higher interest rates reduce the present value of firms with strong growth potential far into the future, such as the mega-cap tech stocks that have boomed in recent years. Higher yields also make it less profitable for companies to borrow to buy back stock or for private equity firms to borrow cheaply to buy out publicly traded firms.

The market environment has changed materially in our view. We don’t expect the investment strategies that worked best in the Golden Years to be as successful in the years ahead. The investments that did best in the past environment of ultra-low interest rates – large-cap tech, private equity, and parts of real estate – are unlikely to lead going forward.

Investing in a New Era

Turning points often arrive when conventional wisdom holds that the current environment is the new normal and will endure. We can’t predict precisely when the turning point will arrive, because trends often persist after the first signals that their day is past. But all rallies eventually falter, and as valuations get loftier, they require ever-stronger results to justify these higher prices. At that point, even small disappointments can lead to large declines in markets or individual stocks.

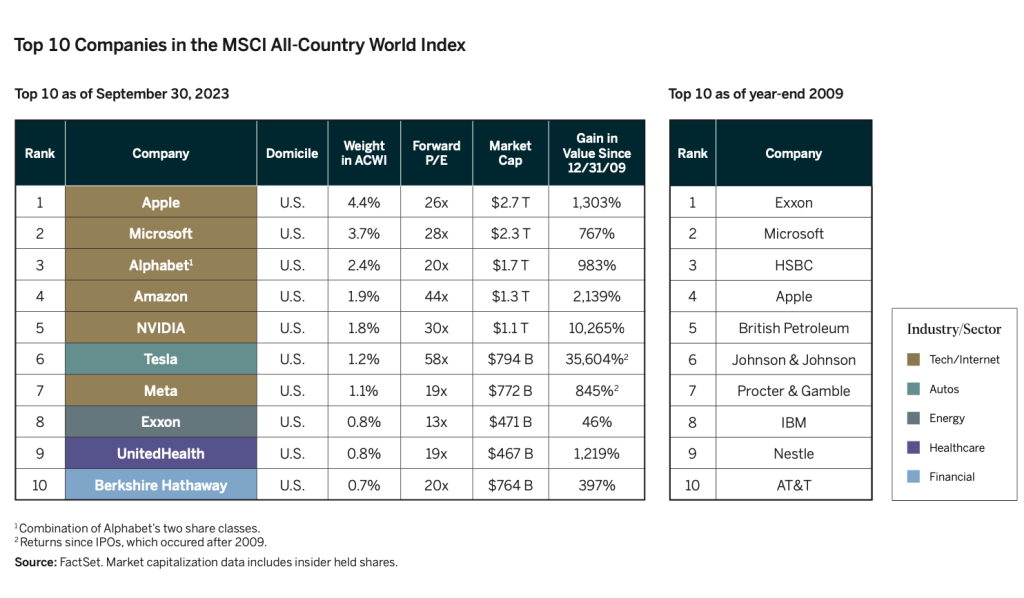

At the end of September, the ACWI was more concentrated than ever before. All of the top 10 companies in this global index were U.S. domiciled. Most are Technology/Internet related. The top 7 accounted for over half of the total return of the ACWI year to date. The top 5 had market capitalizations in excess of $1 trillion and many had soared over 1,000% since the end of 2009.

Many of these companies are fantastic franchises with high barriers to entry and enormous cash flows, but they face challenging growth expectations at their current scale. Some of them are also under intense political or regulatory scrutiny.

In Conclusion

Our Thematic Investing approach seeks to identify the winners of the future by understanding changes underway and the companies best positioned to benefit from them, while keeping a close eye on the macro-economic and market environment.

Over the past year, we have introduced and adjusted several Themes that we believe are well suited for the new investment era we expect. Most notable are our Opportunities Abound Abroad and End of Disinflationary Tailwinds themes. We have also intensified our equity research focus on non-U.S. companies and are evaluating an increase in more defensive equity holdings. We expect to continue increasing our exposure to Energy, Healthcare and value-oriented equities. We are also considering the role bonds could play in a more defensive posture, given the higher yields they offer relative to the recent past.

Above all, we are moving slowly, deliberately and with great care. The market changes described above are likely to play out over several years. Investing requires managing short-term risks, including the risk of being too early, while laying the groundwork for future success.

Important Disclosures This commentary is for informational purposes only. The information set forth herein is of a general nature and does not address the circumstances of any particular individual or entity. You should not construe any information herein as legal, tax, investment, financial or other advice. Nothing contained herein constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments. This commentary includes forward-looking statements, and actual results could differ materially from the views expressed. Materials referenced that were published by outside sources are included for informational purposes only. These sources contain facts and statistics quoted that appear to be reliable, but they may be incomplete or condensed and we do not guarantee their accuracy. Fact and circumstances may be materially different between the time of publication and the present time. Clients with different investment objectives, allocation targets, tax considerations, brokers, account sizes, historical basis in the applicable securities or other considerations will typically be subject to differing investment allocation decisions, including the timing of purchases and sales of specific securities, all of which cause clients to achieve different investment returns. Past performance is not indicative of future results, and there can be no assurance that the future performance of any specific investment or investment strategy will be profitable, equal any historical performance level(s), be suitable for the portfolio or individual situation of any particular client, or otherwise prove successful. Investing involves risks, including the risk of loss of principal. The level of risk in a client’s portfolio will correspond to the risks of the underlying securities or other assets, which may decrease, sometimes rapidly or unpredictably, due to real or perceived adverse economic, political, or regulatory conditions, recessions, inflation, changes in interest or currency rates, lack of liquidity in the bond markets, the spread of infectious illness or other public health issues, armed conflict, trade disputes, sanctions or other government actions, or other general market conditions or factors. Actively managed portfolios are subject to management risk, which involves the chance that security selection or focus on securities in a particular style, market sector or group of companies will cause a portfolio to incur losses or underperform relative to benchmarks or other portfolios with a similar investment objectives. Foreign investing involves special risks, including the potential for greater volatility and political, economic and currency risks. Please refer to Chevy Chase Trust’s Form ADV Part 2 Brochure, a copy of which is available upon request, for a more detailed description of the risks associated with Chevy Chase Trust’s investment strategy. The recipient assumes sole responsibility of evaluating the merits and risks associated with the use of any information herein before making any decisions based on such information.